Spanish, Italian Markets Slammed By Investor Fears

Posted by jcashman

Courtesy of Associated Press

MADRID (AP) — Investors battered Italian and Spanish financial markets on Tuesday, with the countries’ borrowing rates hitting euro-era highs on fears that a global economic slowdown will hurt their chances of dodging Europe’s debt crisis.

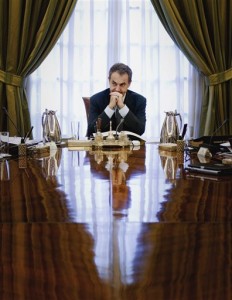

As stocks and bonds nose-dived in Madrid and Milan, Spanish Prime Minister Jose Luis Rodriguez Zapatero delayed his vacation to monitor the increasingly bleak scenario with his finance minister, Elena Salgado.

She told Zapatero “that the experts agree that the current situation is due to the financial crisis plaguing the euro area worsened by the uncertainty of the economic situation in the United States,” Zapatero’s administration said in a statement issued after markets closed.

The yield for the Spanish 10-year bond rose as far as 6.45 percent, the highest since the euro was created and near levels seen in Greece, Ireland and Portugal before they were forced to ask for rescue loans.

Italy’s equivalent bond yield jumped to 6.18 percent, above where it was before July 21, when the EU announced its latest debt crisis plan, including a second Greek bailout, to calm and contain market jitters.

That plan had helped lift spirits briefly, but markets were quickly roiled again by worries that the U.S. economy may be sliding back toward recession.

Coupled with lingering suspicions that the EU debt crisis plan will not be enough to stamp out the crisis, the fears about the U.S. soured market sentiment across the globe.

In times of trouble, traders’ knee-jerk reaction is to sell off what they perceive as high-risk investments — including government bonds in weak European countries — and to buy into safer ones, such as gold and German bonds.

Although Europe’s renewed debt tensions are largely a symptom of a global rise in fears among investors, the impact they have on Spain and Italy, the eurozone’s third- and

Courtesy of Associated Press

fourth-largest economies, is potentially huge. The increased yields threaten Italy’s and Spain’s ability to fund government programs, and both nations are too expensive to rescue for Europe’s bailout fund.

“There is increasing uncertainty in the market and all the peripheral markets, the ones which have weaker political contexts, will continue to suffer,” said Luca Peviania, managing director of P&G, a Rome-based asset management company.

Spain’s main stock index sank for the second day in a row, closing down 2.2 percent after plunging 3.2 percent a day earlier, and hitting its lowest level since July 2010. Italy’s index fell another 2.5 percent.

The market bloodbath caused alarm through the two nations’ political leadership.

Italian Finance Minister Giulio Tremonti called an emergency meeting in Rome to analyze the situation and arranged to meet Jean-Claude Juncker, the chairman of the Eurogroup meetings of eurozone nations, on Wednesday.

Zapatero, meanwhile, delayed his vacation to southern Spain so he could “follow more closely the evolution of economic indicators” with Salgado, his administration said. He also spoke with European Commission president Jose Manuel Durao Barroso about the importance of expediting the second bailout for Greece.

Zapatero’s vacation delay came just four days after he called early general elections for November — largely due to pressure on his administration from the financial crisis and because he wants a new government to manage the troubled economy from the start of the year.

Zapatero announced earlier this year that he will not seek a third term, and the opposition conservative Popular Party is widely favored to take control from Zapatero’s Socialist Party.

Members of Salgado’s team had an “ongoing dialogue” Tuesday with their counterparts in Germany, France and Italy, the government statement said, adding that the market gyrations should be “taken into perspective.”

EU officials sought to downplay the danger of Spain and Italy edging closer toward needing a bailout, but the European Commission said it was monitoring the situation closely.

“We are very confident in both the Spanish and Italian authorities’ determination to get their economies back on track,” said Chantal Hughes, a spokeswoman for the EU’s executive.

She said that in the Commission’s view, “there is no factual evidence (about the two countries’ economies) that has changed in the last few days.”

“The question of a rescue plan (for Spain) is not on the table, it hasn’t been discussed,” Hughes said.

Eurozone leaders agreed July 21 on a second, euro109 billion ($157 billion) bailout for Greece and overhauled their rescue fund in hopes of keeping market turmoil from spreading to Spain and Italy.

But the deal gave only a temporary lift to Spanish and Italian bonds.

Just days later, global markets were rocked by the possibility that the U.S. may default on its debt by not raising its borrowing ceiling. It managed to clinch a deal just in time, but investor sentiment was shaken profoundly. At the same time, U.S. indicators showed its economy was slowing sharply. The combination caused traders to move their cash into the safest investments.

In that context, confidence in the EU crisis plan’s ability to protect Spain and Italy from the market turmoil dropped rapidly.

That is partly because the deal included asking bondholders to take losses on the value of their holdings. Losses for private investors — a first in the 21-month debt crisis — has underlined the risks involved in holding eurozone debt.

High yields show the additional interest investors demand to hold the country’s debt, and underline how a government’s financing costs could rise when they need to tap bond markets again. As fears of default increase, interest rates rise and make paying debt even harder in a vicious circle.

Spain is struggling to recover from nearly two years of recession triggered in large part by the collapse of an overheated real estate sector. Burdened by a swollen deficit, the country’s jobless rate stands at a eurozone high of nearly 21 percent.

Italy has debt of 120 percent of economic output, but had been viewed for months with calm by bond markets. The country has low levels of private debt and has not had the real estate boom and bust that caused trouble for the United States, Spain, and Ireland.

But it suffers from chronically low growth and investors doubt the government’s willingness and ability to push through painful economic reforms.

______

Jorge Sainz in Madrid, David McHugh in Frankfurt, Colleen Barry in Milan, Gabriele Steinhauser in Brussels and Paolo Santalucia in Rome contributed to this report.

Copyright 2011 The Associated Press.

Related posts:

- Greece Suffers New Credit Downgrade

- Dunkin’ Gets Warm Response From New Investors; Stock Doing Better Than Expected

Short URL: http://www.newenglandpost.com/?p=470